Financial Obligation Purchasing New York Real Estate: A Overview for Financiers

Financial obligation investing in real estate has obtained grip as a stable and profitable financial investment technique, specifically in high-demand markets like New York. Unlike typical property investing, where you purchase physical residential or commercial property, financial obligation investing entails loaning resources to realty programmers or property owners in exchange for rate of interest settlements. In return, investors get regular income without the direct administration duties that include property possession. This guide checks out the possible advantages, threats, and opportunities of financial debt investing in New york city realty.

What is Financial Obligation Purchasing Realty?

Financial debt investing in property entails offering fundings to home developers, owners, or buyers genuine estate tasks. In exchange for financing resources, investors obtain normal rate of interest settlements over the life of the car loan. Essentially, debt financiers act like lending institutions, and the realty acts as collateral for the finance.

Unlike equity financiers, who possess part of the home, debt investors are not straight associated with residential or commercial property possession or monitoring. Rather, they have a priority claim on the home's capital, suggesting they are paid prior to equity holders in case of economic issues or liquidation.

Benefits of Debt Purchasing Realty

1. Regular Income Stream: One of the main advantages of debt investing is the constant rate of interest settlements that capitalists obtain. These settlements are usually made on a regular monthly or quarterly basis, supplying a reliable source of easy revenue. For capitalists looking for constant capital, financial debt investing is an eye-catching alternative.

2. Reduced Threat Contrasted to Equity Spending: In realty financial debt investing, the loan is secured by the underlying property, suggesting that if the borrower defaults, the residential property can be offered to recover the investment. Financial debt capitalists have a greater position in the resources pile, which gives them priority over equity capitalists. This lower-risk framework is appealing to those trying to find security in their real estate investments.

3. Access to New york city's High-Value Realty Market: New york city is recognized for its durable and affordable property market, especially in key locations like Manhattan, Brooklyn, and Queens. Nonetheless, buying property in these locations can be prohibitively pricey for lots of investors. Financial obligation investing supplies a way to take part in the profitable New york city realty market without the need for large capital outlays called for to buy home directly.

4. Diversity Opportunities: Debt investing allows financiers to diversify their real estate portfolios without being linked to one specific building. By purchasing finances across various jobs, asset types, and areas, investors can spread risk across several financial investments, making their profiles more durable to market changes.

Sorts Of Property Financial Obligation Investments

1. Senior Fundings: Elderly lendings are the most safe and secure form of financial obligation investment in realty. These financings are secured by a first lien on the residential property, implying that if the debtor defaults, the lending institution has the very first insurance claim to the profits from the sale of the home. Due to their lower danger, senior finances usually use reduced interest rates contrasted to various other types of financial debt.

2. Mezzanine Loans: Mezzanine finances are higher-risk lendings that fall between senior financial obligation and equity in the funding pile. They are not straight protected by the building yet rather are safeguarded by equity in the loaning entity. Mezzanine loans typically offer higher interest rates than senior loans, reflecting the additional threat involved. These fundings are commonly utilized by designers to bridge financing gaps in between the elderly finance and equity financial investment.

3. Preferred Equity: While not practically a financial obligation investment, preferred Debt investing real estate New York equity features in a similar way to mezzanine fundings. Preferred equity financiers have a priority over common equity owners however are junior to debt investors. This financial investment choice frequently offers greater returns, however with higher connected threat.

4. Realty Crowdfunding Platforms: Property crowdfunding systems have made it less complicated for private investors to participate in financial debt investing. These platforms swimming pool funding from multiple capitalists to fund property fundings, frequently providing accessibility to both senior and mezzanine financial obligation opportunities. Systems like Fundrise, RealtyMogul, and PeerStreet allow capitalists to diversify throughout various projects with lower minimal investments.

Financial Obligation Investing in New York City Real Estate: Secret Considerations

1. Understanding the Regional Market: New york city's realty market is extremely competitive and differs dramatically by region. Manhattan's high-end domestic market operates extremely differently from industrial tasks in the outer boroughs or suburbs. Before purchasing financial obligation opportunities, it's critical to comprehend the details market where the project is located. Aspects like residential or commercial property demand, openings rates, and future development can all affect the success of a property project.

2. Assessing the Debtor's Creditworthiness: In debt investing, the customer's capacity to settle the lending is crucial to your financial investment's success. See to it to conduct due diligence on the customer's performance history, economic wellness, and experience in real estate development. A solid borrower with a history of effective jobs is much less most likely to default, lowering the danger of your investment.

3. Loan-to-Value Ratio (LTV): The loan-to-value ratio is a important statistics to review in the red investing. LTV gauges the quantity of the financing about the property's value. A lower LTV proportion (e.g., listed below 65%) shows that the financing is well-secured by the property, making it a more secure financial investment. Alternatively, a greater LTV proportion boosts the danger, as there is less equity securing the finance.

4. Rate Of Interest and Returns: Rate of interest for real estate debt investments can differ based upon elements like car loan type, task threat, and market problems. Senior car loans generally offer reduced returns (5% -8%) because of their lower threat, while mezzanine fundings or preferred equity financial investments can use returns in the range of 9% -12% or greater. Examine the prospective returns relative to the threat profile of the investment to guarantee it aligns with your economic objectives.

5. Legal and Governing Considerations: Real estate financial obligation investing in New York undergoes state and federal regulations, especially concerning securities offerings. If you are spending through a property crowdfunding platform, make certain the platform is certified with policies stated by the Securities and Exchange Payment (SEC). Additionally, acquaint yourself with any type of state-specific regulations that may impact your investment.

Prospective Threats of Financial Obligation Buying Realty

1. Market Variations: While debt investing is normally more stable than equity investing, property markets are still subject to financial variations. A recession in the New york city real estate market, for instance, could cause reduced home worths, making it more difficult for customers to settle their loans. In extreme cases, this might lead to financing defaults and a loss of investment.

2. Default Danger: The key threat in debt investing is customer default. If a debtor is incapable to make interest settlements or repay the funding, financial debt capitalists may need to start foreclosure procedures to recoup their financial investment. This procedure can be time-consuming and costly, and in some cases, the home's worth might not suffice to cover the financing quantity.

3. Liquidity Threat: Financial debt investments are generally illiquid, suggesting you might not be able to easily sell your investment before the lending's maturity date. Be sure to consider your liquidity needs Green Springs Capital Group before devoting to a property financial debt financial investment.

Financial debt investing in New york city realty uses a distinct chance for capitalists seeking steady revenue and reduced danger compared to conventional equity investments. With the right due persistance, financial debt capitalists can take advantage of the flourishing New York property market, gain from constant interest payments, and appreciate the safety of genuine estate-backed investments. By recognizing the regional market, assessing borrower credit reliability, and choosing the best sort of finance, you can produce a diversified property financial obligation portfolio that straightens with your monetary objectives.

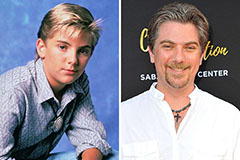

Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Bug Hall Then & Now!

Bug Hall Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now!